In this age in which about 90% of all private investors execute their trades online, online brokerages bear an important role as the gatekeepers to prevent unfair trades, via the surveillance of several millions of trades each day. This situation, however, has brought online brokerages into conflict with a new harsh reality: the shortage of human resources. To get around this problem, kabu.com Securities Co., Ltd. decided to introduce and meticulously train artificial intelligence (AI).

kabu.com Securities Co., Ltd. (hereafter, "kabu.com") was founded in 1999. Having joined the Mitsubishi UFJ Financial Group (MUFG) in 2006, it is an online brokerage that has achieved continuous growth by taking advantage of MUFG's customer base and service expansion achieved through in-house system development. As reflected in President & CEO Masakatsu Saito's statement about his company, that "we are half a systems company," kabu.com is working on the systemization of operations previously performed by people as it ramps up support for FinTech, a new trend in financial services.

In recent years, the online brokerage industry has experienced tremendous growth. The driving force behind this is the world of private investing. It is reported that 85% to 90% of all stock trades of private individuals are now done online. This has created a situation in which brokerages are now being called on to act in their capacity as a contact point for investors as “gatekeepers” to prevent unfair trading. As ways of market manipulation become more sophisticated, the extent to which monitoring rogue behavior to ensure fair price formation can be carried out will be critical.

Trade surveillance is similar to craftsmanship in that past heuristics are all-important. Suspicious behavior is detected by looking at how many orders are placed at which timing, or from patterns in a series of trades. kabu.com has a limited number of experts who can take charge of trade surveillance. Nevertheless, with the number of trades rising, rogue methods are also becoming more sophisticated.

According to Mr. Saito: "What we want are not novices, but highly experienced people who are effective from day one. Recruiting such people now, when people are hard to find anyways, is hard. Besides, it is basically impossible to search through all of the several million trades that occur daily no matter how large our staff. All things considered, we had no choice but to automate." In an environment of fierce competition for human resources in the brokerage industry, where all the talented people are already employed, kabu.com found a way out of this situation via AI.

Masakatsu Saito, President & CEO, kabu.com Securities Co., Ltd.

As a way to mitigate the shortage of human resources, kabu.com considered introducing Hitachi's AI product, known as "Hitachi AI Technology/H" (hereafter “AT/H”). Says Mr. Saito: "We tried analysis AI, image recognition AI, language processing AI, all kinds of AI from everyone from venture startups to major companies." His reason for selecting Hitachi's AI was its strengths in analysis and figures, enabled by Hitachi's proprietary Leap Learning technology, making it appropriate for the financial operations of a brokerage. kabu.com then began applying it to two of its operations: stock-lending and trade surveillance.

Stock-lending is a transaction in which stock owned by an investor is temporarily loaned to a brokerage firm for which a commission is received. Stock borrowed from an investor by a brokerage is then lent to other institutional investors or supplied as stock for short-selling in order to create revenue. However, even as demand continues to grow each year, kabu.com has a mere three traders negotiating about 500 lending transactions a day. With trade surveillance being done in a similar situation, it became desirable to increase the number of talented traders.

The first operation to which AT/H was applied was the determination of stock lending rates—a particular bottleneck. A system was configured that analyzes over 1,000 types of numerical data and automatically calculates the optimal lending rate. This made it possible to greatly reduce the response time to institutional investors, resulting in a 30 to 35% rise in sales from the stock-lending operation. As Mr. Saito comments: "Probably no one is aware that we are handling this with AI. This success just reinforces my own recognition of AI as a technology for making money."

The next operation targeted for AT/H application was trade surveillance. Adopted by the Tokyo Stock Exchange, AT/H is in use in examination during the initial phase of trade surveillance. This system frees the trade surveillance officer to focus only on detailed full-scale surveillance.

Proof of Concept (PoC) for AT/H application to trade surveillance was carried out on "layering"—a technique that attracts third parties to trades by initiating a large volume of trades without any intention of completing them. The verification process went forward as Ikuo Kurosawa, chief of kabu.com's Trading Screening Section, and Hitachi engineers went through numerous rounds of direct discussions.

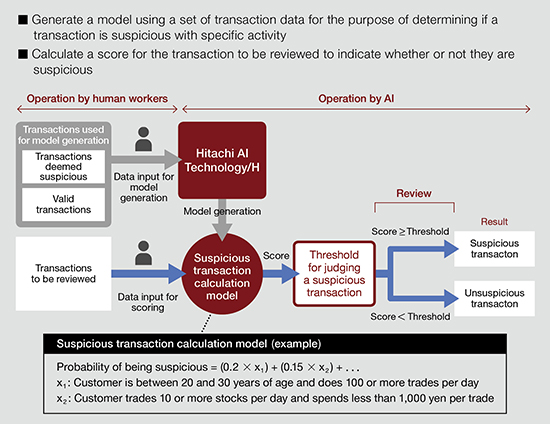

The main feature of AT/H is a Hitachi proprietary technology known as "Leap Learning." "Deep learning," a familiar AI technology, is characterized by calculations that, like the interior of a black box, are unknowable. In contrast, a feature of Leap Learning is that it expresses via a model what kinds of reasons are behind certain results. (Figure 1)

Procedure for determining suspicious trades using AI (Figure 1)

Specific trade conditions used in judging suspicious trade activity, such as [trader age of between 20 and 30] plus [number of trades per day exceeding 100], are shown in the model. For this reason, even if AI was not able to detect unfair trading during the learning process, this serves as a clue in considering the kinds of conditions setups that need redoing. In addition, having AI learn new methods of sales transactions allows the model to be tuned, making it possible to approach areas handled by people with intuition and years of experience.

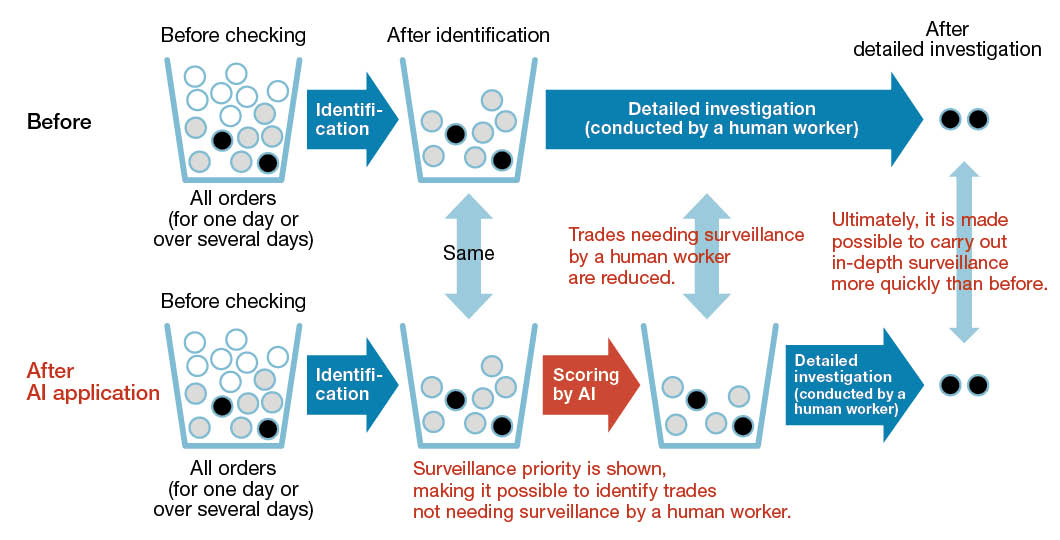

Hitachi learned from direct interviews with Mr. Kurosawa the kinds of patterns that had a high probability of falling under “unfair trading.” Based on this, Hitachi then formulated a hypothesis and generated an unfair trading determination model using AT/H. Trade data for the verification process was input into this model, which then performed scoring for the probability of unfair trading. After the results were checked by Mr. Kurosawa, the PDCA cycle was executed in order to redo the conditions setup. As a result, scoring by AT/H made it possible to exclude 73% of the trades that did not need surveillance such that the trade surveillance officer had only to look into the remaining trades. Next, PoC was executed for cross-trading, in which the same officer initiates sell and buy orders at the same time and price. This resulted in being able to exclude over 90% of all trades. (Figure 2)

After six months of PoC work, the system was implemented in an exceptionally fast 2.5 months, with full-scale operation launching in August 2018. As Mr. Kurosawa notes: "In the face of tough demands, some of our discussions were more like arguments." The application of AI in such a short period can only be attributed to how Hitachi engineers and kabu.com's workplace leaders worked closely together against a backdrop of sincere discussion.

Mr. Kurosawa describes the benefits of implementation as follows: "The workload on everybody was drastically reduced, and because it felt like an injection of new staff members into the team, the overall feeling of the team got radically better." Emphasizing the unique merits of Hitachi AI featuring model indicating, he adds that "AT/H lets us visualize know-how by indicating in a model customer behavior that is highly correlated with layering. This is the same thing as receiving training from an experienced trade surveillance officer."

"The presence of a trainer who trains AI is of upmost importance. Treating AI with the same care as a valued apprentice will produce huge leaps forward in implementation benefits," says Mr. Saito. The AI will gain know-how equivalent to that of experienced employees and will convey that to the next generation. It is as if the company simultaneously acquired both a talented employee and a teacher.

Application of AI to layering surveillance (Figure 2)

"Our goal," says Mr. Kurosawa, "is to complete surveillance operations that normally take several hours in just 30 minutes." The possibility for this is already in view. In addition to market manipulation, kabu.com will apply AT/H to the detection of possible insider trading, suspicious trades, and all other activities belonging to trade surveillance operations. kabu.com will also build an ecosystem in which we can provide forecasted stock lending rates to other brokerages who are ordinarily rivals." As Mr. Saito says, "This idea, that AI can act as a generator of revenue, was conceived at the workplace and is proof that we have gained an awareness of ourselves as business owners."

Collaborative creation is indispensable toward finding solutions to the complex issues of modern society. In order to contribute to the development of a sound securities business, kabu.com and Hitachi will continue to engage in collaborative creation projects as long-term partners.

Release Date: March 2019

Solutions By: Financial Institutions Business Unit, Hitachi, Ltd.