Transferring money today is a rather simple process. For many of us, it is as simple as whipping out our mobile phones to scan a QR code. For the 290 million unbanked Southeast Asians however, sending money home remains a critical issue they grapple with in their daily lives.

To secure a job with decent wages, many job-seekers in the region have to leave their rural hometowns and loved ones to work in a distant city. In the Philippines, 49% of those aged 15 and above have left their hometowns, with most of them heading to Metro Manila in search of better employment prospects.

Many of such workers in the Philippines tend to work in low-paying jobs with poor working conditions and long hours. They struggle to raise enough money to cover the costs of living in the cities, as well as to send remittances home to support their families.

The timely transfer of cash to their loved ones is vital — their family members need it to put food on the table, pay for utilities, and send their children to school. However, even after receiving their hard-earnt wages, remitting this money back home may not be a straightforward process.

Here at Hitachi, we took a step back to see how we can complement existing payment services to improve convenience for our users.

What if it was possible for our users to make transactions easier, safer, and faster?

With our Cash Recycling Machines (CRMs), users can easily deposit cash at a CRM and allow another person to conveniently withdraw that money from their nearby CRM. In collaboration with Seven Bank, this service has now been successfully implemented across the Philippines.

By the end of 2021, over 1,200 CRMs were deployed in 7-Eleven stores across Metro Manila and adjacent cities, with plans in place to install more CRMs in 7-Eleven stores all across the country. In doing so, we hope to provide greater access to convenient cash transaction services for all Filipinos.

It is now possible for Filipino workers to easily transfer cash back to their loved ones. Transacting via the CRM is simple, accessible, and will drastically improve the lives of those who need cash deposits or withdrawals.

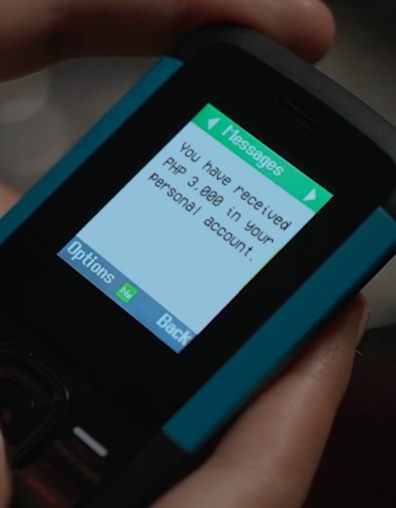

More convenient features are also being planned, such as a feature where recipients will be able to send and receive cash via our CRMs through a simple, yet secure mobile phone verification process.

CRMs make cash transactions fast, easy and safe

CRMs make cash transactions fast, easy and safe

There are plans to introduce more features, such as a cash transfer service via a simple mobile verification process

There are plans to introduce more features, such as a cash transfer service via a simple mobile verification process

Hitachi aims to install more CRMs, thereby adding to the existing 1,450

Hitachi aims to install more CRMs, thereby adding to the existing 1,450

This is our way of helping all Filipinos, including the over 51 million unbanked Filipinos, who dedicate themselves to providing a better life for their loved ones. By applying social innovations to real-life problems in Southeast Asia, we stand ready to work side-by-side with our partners to improve the quality of life for millions of people in Southeast Asia. Here at Hitachi, we are always thinking of ways to power good for the advancement of society and its people.

Date of Release: February 2022