Finger vein authentication enables payment with a single finger

As the COVID-19 virus continues, rising numbers of people are relying on cashless payment in order to avoid viral transmission through the exchange of cash. Cashless payment generally brings to mind credit cards, but recently, other payment services in Japan, such as PayPay1 and LINE Pay2, which allow payment using a smartphone, have been rapidly gaining use.

Against this backdrop, biometrics authentication is drawing attention as a new means of cashless payment by making it possible to purchase goods without having to carry around a smartphone or a wallet. Biometrics authentication is a technology that enables individuals to be identified by using different parts of the body, such as the face or palm of the hand. One such application, finger vein authentication, which identifies individuals by the veins in their fingers, is garnering high expectations for use in the future because of its high level of convenience and safety.

Mr. Takeyuki Mayumi is working on the dissemination of biometrics authentication at Hitachi. He says that "Demand for biometrics authentication has risen globally. In Japan, some financial institutions have started commercialization, and the retail and restaurant industries have also begun considering introduction to their services."

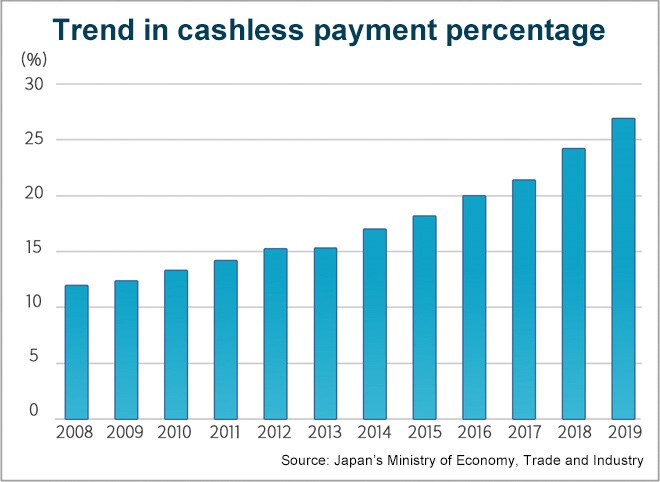

In Japan, according to the Ministry of Economy, Trade and Industry, the percentage of cashless payments rose from 11.9% in 2008 to 26.8% in 2019. As need for cashless payment rose, the Japanese government announced in 2018 its "Cashless Vision" for creating a cashless society. This vision stipulates a policy of achieving a percentage of 40% by 2025 and an eventual future goal of 80%.

Various means of cashless payment exist today. One now attracting attention is finger vein authentication, which identifies individuals from the patterns of veins on their fingers. This is accomplished by shining infrared light through the finger to detect vein patterns that identify the individual. Constituting internal body information, finger veins are safe to use because they have constructions that are unique to each person, thereby providing a barrier to forgery or identity fraud.

Moreover, because all payments can be made with a single finger, it is possible to make a purchase without having to carry around a smartphone or wallet. Gone will be the anxiety of forgetting one's wallet or the hassles of reporting a lost credit card. The payment transactions that we are accustomed to will become more convenient.

Mr. Rui Nakamura, in charge of the finger vein authentication project at UC CARD Co., Ltd.

To realize finger vein authentication-based payment, in 2018, Japanese credit card company UC CARD Co., Ltd. and Hitachi established a joint project that is engaged in demonstration testing and other activities. Recalling the inspiration for the project, Mr. Rui Nakamura of UC CARD, relates as follows:

"From about the summer of 2018, when we began to see the use of biometrics authentication-based payments, mainly in overseas, we also began considerations. It was about this time that I read in a newspaper an article about how Hitachi had begun using payments based on finger vein authentication at its employee cafeteria. This inspired me to approach Hitachi."

There are many ways to carry out biometric authentication, including facial recognition and palm recognition. Mr. Nakamura focused on finger vein authentication for the following reason:

"We were hearing from many of our member stores that, with the current mishmash of different payment methods, it was difficult to install already bulky payment equipment because of limited space around cash registers. It therefore seemed to me that finger vein authentication would be easy to apply since you only need space for a single finger."

Demonstration testing in action

Demonstration testing was carried out at five restaurants and drugstores with about 650 employees from both UC CARD and Hitachi as test subjects. After users completed a registration process to link their finger vein information with their credit card information, testing was carried out to verify whether or not payment using a single finger would proceed glitch free. Test results showed that payments could be completed in less than one second, equivalent to the processing time for electronic money, which is considered to be one of the fastest means for cashless payment systems.

According to Mr. Nakamura, "People like us at credit card companies are constantly dealing with cashless payments. Even so, we assessed it highly and appreciated the extreme ease of use of finger vein authentication."

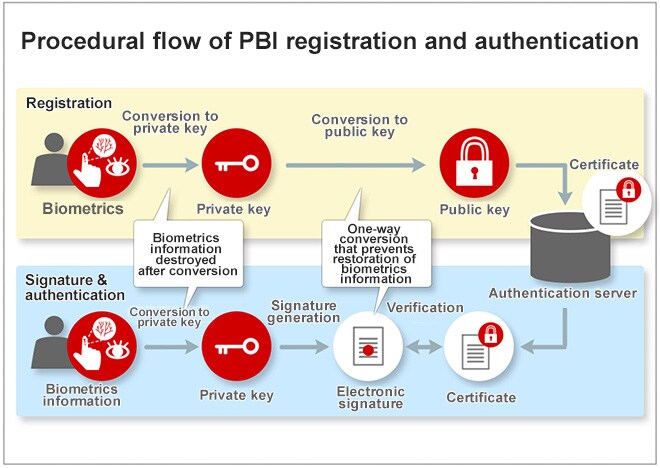

To bring about the widespread acceptance of biometrics authentication in society, not only convenience but safety must be ensured. Because biometric information cannot be re-written or deleted, security for preventing malicious use caused by information leakage is a major issue.

Gaining notice in this respect is Hitachi's Public Biometrics Infrastructure (PBI), a system for enabling the safe handling of biometric information. With this system, biometric information is registered in a form that cannot be restored, ensuring its secure use from a security standpoint.

Mr. Mayumi says, "With PBI, instead of its original state, biometric information is registered in a form that cannot be restored. Therefore, even if stolen, registered information cannot be misused as biometric information."

PBI: Enabling payment and identity verification in all kinds of situations

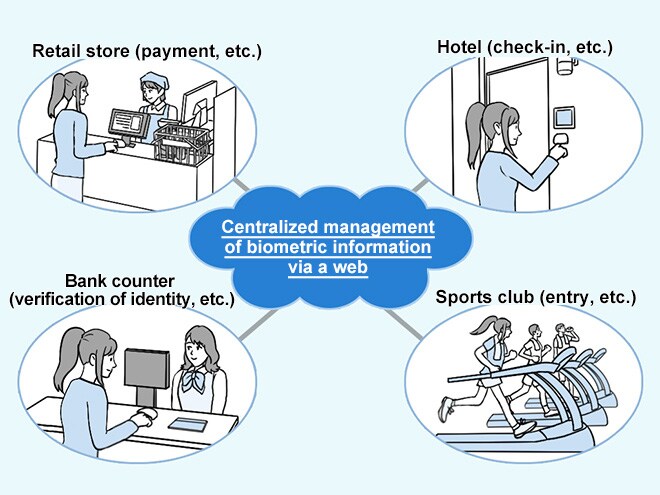

Another major feature of PBI is that biometric information is centrally managed on a web server. Biometric information is converted to non-restorable data that is registered in the server. In the use of biometric data, accessing an authentication server via a network enables identity verification, payment, and other such applications in all kinds of situations.

Proof of Concept for this project was carried out from the perspective that using PBI enables the safe use of finger vein authentication. According to Mr. Nakamura, test results indicated no concerns from a security standpoint and that both safety and convenience were palpable.

He goes on to say that "While smartphones dramatically changed our daily life, I envisage a world in which biometrics authentication is just as normal as smartphones are now. As biometrics authentication becomes generally accepted, PBI may very well become the technology for ensuring safety."

Mr. Takeyuki Mayumi, Hitachi,Ltd. works toward the widespread use of biometrics authentication

Responding to the success of demonstration testing, Mr. Mayumi would like to see the widespread use of PBI-based finger vein authentication in a number of situations.

"One example would be banks. Stamps are required for identify verification, but finger vein authentication would make them unnecessary. Not only would this be convenient for users, banks would also enjoy such conveniences as not requiring hardcopy documents. Also, for example, after a disaster when it might not be possible to bring a personal seal, you would need only present yourself at the bank in order to withdraw money."

In addition to supporting use for hotel check-ins, elections, or other situations requiring identity verification, finger vein authentication shows promise for use in places where people pursue activities without carrying anything on them, such as at sports clubs and public baths. A future in which identity verification and payments are done using a single finger is just around the corner.

As Mr. Mayumi concludes: "I think it would be great to make it possible to verify identity at hospitals, public facilities, and all kinds of other situation simply by waving a single finger, thus creating a world in which people can enjoy services in this way. This technology just might be able to change our lifestyles by creating a future society in which people can go out with nothing on them and still be able to safely and securely pay for things and identify themselves."

Although finger vein authentication is currently being implemented in the form of contact-type equipment, research and development with a view toward non-contact equipment is underway. As cashless payment gains attention due to the COVID-19 pandemic, expectations are growing for its use in the future.

1, 2 The products names are registered trademarks or trademarks of their respective companies.