FinTech is transforming the financial services industry today, with completely new services already appearing worldwide. The insurance industry is also experiencing change through the emergence of InsurTech.

(InsurTech is coined from the word “Insurance” and “Technology”.)

One company making advanced efforts in InsurTech is Dai-ichi Life Insurance Co., Ltd. Based on a collaborative research with Hitachi that utilizes medical big data, the company is incorporating innovation in its life insurance business that provides " peace of mind " and " extensive health support" throughout the customer's lifetime.

Japan is rapidly aging. By 2025, around 18% of its people will be over the age of 75. Around 10 million in this nation suffer from diabetes, a record high. It is crucial for Japan to build a framework that enables people to enjoy quality lifestyles by constraining the prevalence and severity of such lifestyle diseases and preventing national medical expenditure from expanding.

There is rising hope that digital innovation using big data or artificial intelligence can help resolve these issues.

For example, the complex analysis of medical data from medical institutions, health insurance union and other organizations could enable the earlier detection of various diseases and grasp the tendency of those deseases. Such learning could be used to improve the quality of preventive medicine, enhanced nursing care, and maintaining health. In other words, medical big data would be put to the test to generate new value.

We are already seeing innovations materialize. One company leading the way is major Japanese insurer Dai-ichi Life.

To bolster its role as a provider of peace of mind and extensive health support aligned with the life cycles of customers, Dai-Ichi Life puts together its own InsurTech activities to drive its own life insurance innovation, which it calls “InsTech”. The company gathered around 30 top talents from various departments to establish the InsTech Innovation Team, which pursues advances in three top priority strategic areas. These are healthcare, underwriting and marketing.

But Dai-Ichi Life found it hard to go alone in InsurTech, which demands the latest technologies and expertise. So, the company brought in outside development resources and engaged in external collaboration and ecosystem work with other industries.

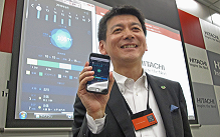

Kenji Itaya, who oversees underwriting product and service development for the InsTech Innovation Team says that, “With various cross-industrial collaborative business models emerging, there is no room for complacence in the life insurance industry. Actually, other sectors have new perspectives and clues that we could not identify by ourselves. We need to generate mutually beneficial synergies for innovation.”

Dai-ichi Life accordingly began a joint research with Hitachi in September 2016. After about a year, the two developed a quantitative assessment model to predict the likelihood of hospitalization and lengths of stay stemming from lifestyle diseases.

This model was the fruit of three elements. Medical big data on around 10 million Dai-ichi Life policyholders, medical knowledge from insurance underwriting, and the analysis know-how from Hitachi’s medical expense prediction technology*. Dai-ichi Life used the model to review its underwriting criteria and provide coverage for some high-blood pressure patients undergoing active treatment.

Mr. Itaya says that, “Previously, the doors to life coverage were either open or closed, with higher premiums than usual for individuals with health concerns, the ones who actually most need an insurance. To fulfill our social mission as an insurer, we wanted to provide coverage that delivers peace of mind to more customers by using InsTech and offering the same premiums for everybody.”

Dr. Kei Adachi, who looks after policy underwriting assessments as an in-house physician, says that, “Adult lifestyle diseases like high blood pressure and diabetes constitute the highest prevalence and risk groups in Japan. Since these illnesses can lead to life-threatening strokes or heart attacks, sufferers are more anxious than those who do not have those symptoms. That is why we set about developing this model.”

Insurers have traditionally made uniform decisions about whether to provide coverage or special contracts for people with lifestyle diseases or those who have histories of such diseases. But not everyone with the same illness faces the same risk. The quantitative assessment model enabled detailed decision-making to assess coverage for each individual.

Why did the company choose Hitachi to partner on this project? It was because Hitachi’s expertise in an array of initiatives over the years have resolved issues in the healthcare field.

Hitachi has developed a range of medical technologies and solutions, including in diagnostic imaging, notably for magnetic resonance imaging and ultrasonic diagnostic equipment. It has also developed electronic health records and testing systems for hospitals and medical institutions in Japan and abroad.

The company also built a disease progressionmodel that uses artificial intelligence to predict incidence rates of lifestyle diseases and total medical expenses. Based on this model, it developed a solution to control annual medical expenditure on lifestyle diseases. The joint research with Dai-ichi Life drew extensively on Hitachi’s advanced technologies and know-how.

Before engaging in joint research, Hitachi used NEXPERIENCE, a systematic process of collaborative creation with the customer to consider and share a new vision or business model to ensure that collaboration with Dai-ichi Life would go well. The two companies engaged on far-reaching discussions on creating customer value with InsTech by combining their knowledge looking 10 or 20 years ahead in a joint workshop.

In the course of developing a quantitative assessment model to predict the likelihood of hospitalizations and lengths of stay owing to lifestyle diseases—the first research theme—Hitachi’s analysis experts worked full-time for a year in the Dai-Ichi Life department that assesses life coverage. Through this on-site work, they gradually acquired an understanding of the nature of policyholder data ( information when buying coverage, status when hospitalized after a considerable period, etc…) and assessment conditions. They also developed a technique to analyze risks for individuals with multiple diseases, and visualize the evidence of those analytical results, leveraging the medical data such as medical checkups and insurance claims of the 110,000 members of the Hitachi Health Insurance Society. They devoted extensive time and effort to evaluate and validate the findings.

Dr. Adachi is very pleased with his company’s collaboration with Hitachi. He says that, “Our hypothesis was that, even with high blood pressure symptoms, hospitalization and operation risks because of the symptom is no higher than that of a healthy individual, if the situation is controlled properly through hospital visits and medication. We found it very meaningful that we could verify that hypothesis with the model for predicting hospitalization probabilities. It is also a groundbreaking that we can now predict the health risks of individuals with multiple illnesses.”

Hard work is starting to produce solid results. Revising underwriting criteria based on the model meant that more than 300 individuals, who previously were unlikely to get coverage owing to their health condition, could now purchase insurance coverage, only a month after Dai-Ichi Life adopted the new criteria in July 2017. Dr. Adachi notes that, “In a year or so, we look to provide coverage to an additional 2,000 people who previously found it hard to get insurance.”

This new business model of broadening the customer base while controlling risks has tremendous impact on the life insurance industry, which is concerned with declining numbers of policyholders amid a decreasing birth rate. Dai-ichi Life’s management was also very satisfied with this outcome, and plans to continue focusing on bolstering services to materialize its “Customer First” corporate philosophy.

In light of the success of their initial effort, Dai-ichi Life and Hitachi entered a second stage of joint research in September 2017. They are undertaking basic research focused on changes in individual medical conditions and lifestyle habits.

For life insurance policies, firms normally determine whether or not to offer coverage based on the health of applicants. But the risks of hospitalization or loss of life may differ among two applicants with the same health conditions depending on how their medical conditions and lifestyle habits change. Dai-Ichi Life therefore plans to review the coverage scope, develop services to prevent the prevalence and severity of diseases, and improve health by assessing changes in health conditions over time instead of assessing people just at the time of applications.

Mr. Itaya says that, “InsurTech initiatives everywhere, not just at our company, are poised to transform business models for the entire life insurance industry. To date, our model has centered on financial support in emergencies. But we will function more as a lifetime partner to promote quality of life and healthy life expectancies for each customer.”

The application of medical big data is a turning point for the venerable insurance business. Dai-ichi Life Insurance plans to keep pioneering innovation in its industry in Japan by pursuing cross-industrial collaboration.

Hitachi will continue collaborating with other companies to create advanced healthcare solutions that improve the quality of life and bolster medical quality, and contribute to healthy, secure, and safe lives in societies the world over.

Release Date: February 2018

Solutions By: Hitachi, Ltd. Financial Institutions Business Unit